The CNC machining industry, like the general manufacturing industry, was impacted by several challenges these years. The Covid-19 pandemic resulted in numerous stops and starts, revenue crashes, and worker layoffs in extreme cases. With many manufacturing shops closed for business, predicting the trends for CNC machining can be quite tricky. However, manufacturing continues to remain an essential part of the global economy, and CNC machining remains a crucial solution for precision and excellence. Here are some of the trends most likely to define and shape in the CNC machining space:

1. Digital manufacturing / Manufacturing-as-a-Service

With more and more companies likely to adopt remote working and work-from-home solutions, CNC machine shops can expect to collaborate virtually and engage more digital manufacturing services.

We also envision a climb in MaaS options with more regions opting to have CNC machines in central locations where multiple people can subscribe to access the device to prototype or manufacture their parts according to schedules.

MaaS improves and delivers on the much-needed diversity in supply chains across regions. It also adds agility, productivity, and cost optimization to CNC machine projects for product engineers that may not afford one-on-one engagements with highbrow CNC machine shops.

2. 6-axis CNC machining

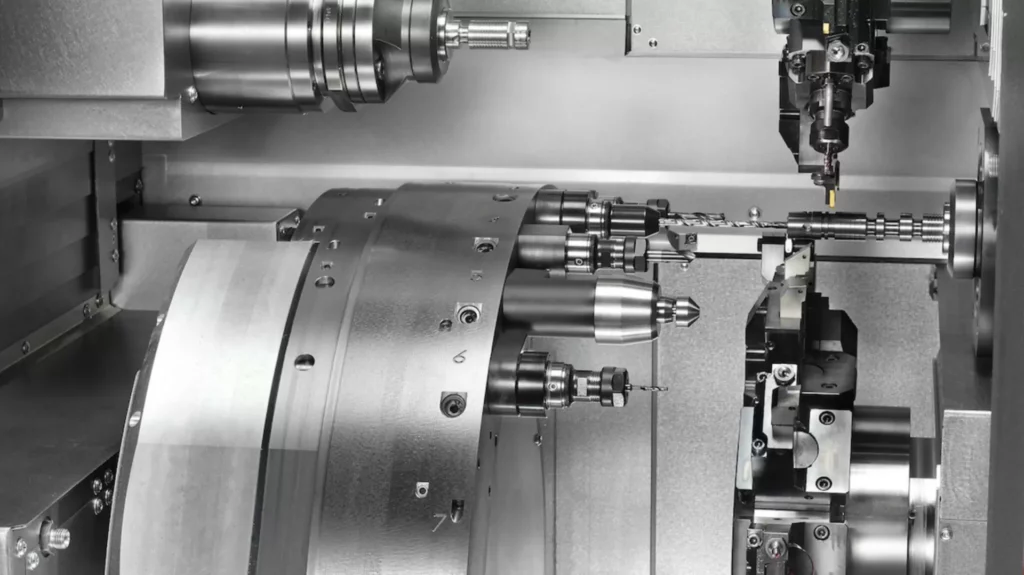

While 3 and 5-axis CNC machines are very likely to remain the staples for subtractive manufacturing techniques, we envision some early engagement and gradual adoption of 6-axis CNC milling machines.

The 6-axis machines will deliver more speed, precision, and accuracy, allowing additional rotations along the Z-axis. If it successfully becomes an industry staple, many product developments and commercial clients can expect even quicker leadtimes and more significant economies of scale in their supply chain.

3. CNC goes green

As manufacturing remains one of the key drivers of environmental pollution, we expect CNC machining to comply with numerous regulations to tilt towards a greener future. Many companies will be focusing on using batteries and other non-fossil fuels and try to cut down on carbon emissions and environmental production.

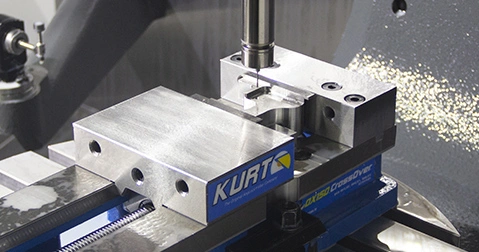

4. Robotics / Automation

In times of the lockdown and pandemic, companies with some robotic workforce were more equipped to survive the lowdown of lesser human presence in manufacturing hubs. In 2021, we expect more automated processing lines and the use of more floor robots and Cobots. Robots will reduce repetitive human tasks, reduce risks, and guarantee lesser errors from human inputs. Cobots will work alongside humans to intuitively perform tasks and complement operator inputs.

We foresee the use of many robots with varying end-effector uses for applications in CNC automotive, aerospace, medical, engineering, and general production operations.

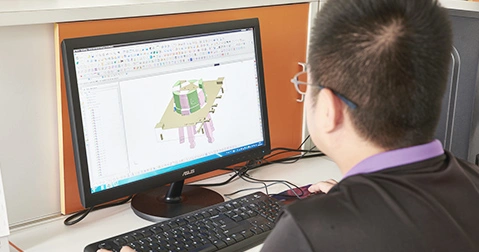

5. CAD/CAM software upgrades

With CAD/CAM software become more widespread and accessible, we can expect several bug fixes and updates that will improve the user-friendliness, operational efficiency, power, customization, and accuracy of CNC machine workflows.

CAD/CAM will also feature new integrations with machine platforms, early explorations of the 6-axis machine capabilities, 3D viewing systems, and project management solutions.

6. Demand for skilled operators

Contrary to the belief that automation will eliminate the need for the human workforce, we predict a higher climb in demand for skilled operators. In the CNC industry, skilled machinists and experts will remain invaluable, helping the company drive automation till it becomes staple and reliable.

For semi-skilled labor, we can also expect a climb arising from a rebound from the economy in 2021, where companies will need more workforce to deal with the leadtimes that all interrupted orders require.

7. Waste reduction and operation scaling

With Covid-19 disrupting the global supply chain, we can expect CNC machining operations to be geared towards even more cost savings and waste reduction. The availability of raw materials and the trade-off between cost and precision may also determine whether there might be a loss of market share to additive manufacturing of smaller-scale objects.